Consumers Count: Five years of the CFPB standing up for consumers

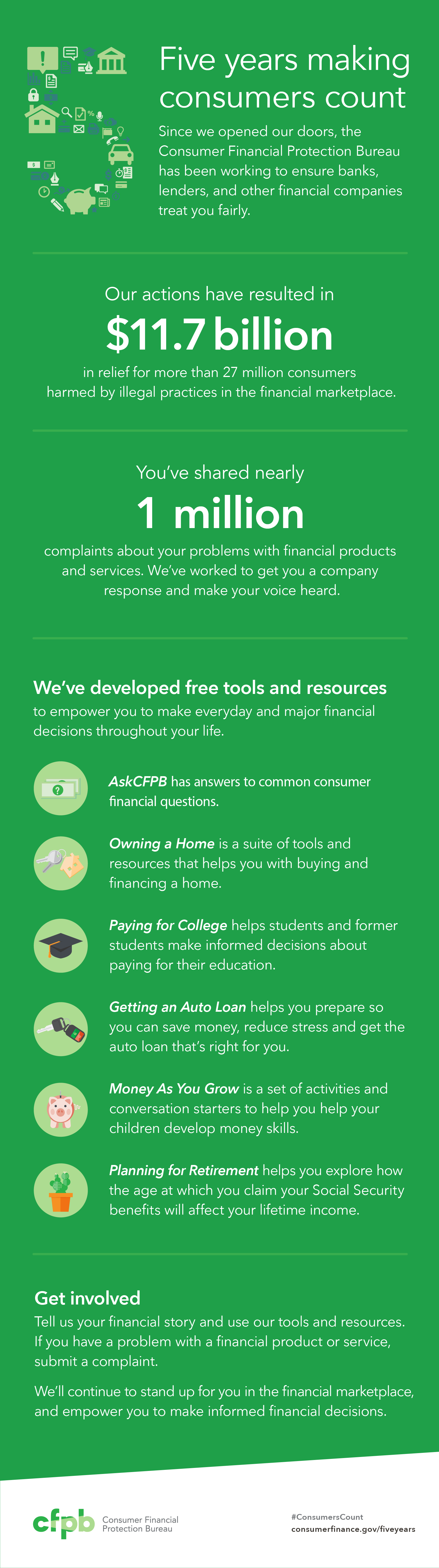

This week, the Consumer Financial Protection Bureau turns five years old! As part of our efforts to tell more people about the CFPB, we're cross-posting this video blog and comments written by Zixta Q. Martinez of the CFPB (check out the infographic at the end, too!).

This week, the Consumer Financial Protection Bureau turns five years old! We’re very proud to have been a part of building it and defending it; we’re also very proud of the many achievements the youthful CFPB has made to make the financial marketplace fairer for consumers. As part of our efforts to tell more people about the CFPB, we’re cross-posting this video blog and comments written by Zixta Q. Martinez of the CFPB explaining what the CFPB does for you. (Check out the infographic at the end, too.) We hope you agree with us: The idea of the CFPB needs no defense, only more defenders.

Consumers Count: Five years standing up for you

July 21, 2016, marks five years since we opened our doors.

We want you to join us as we reflect on five years working to ensure that banks, lenders, and other financial companies treat you fairly.

After the 2008 financial crisis, Congress created the CFPB as the only federal agency with the sole mission of protecting consumers in the financial marketplace.

Since we opened our doors, we’ve focused on making the financial marketplace work for consumers. We’ve listened to your complaints about problems with your financial companies, created new consumer protections for financial products and services, and held bad actors accountable for breaking the law. We’ve also created new tools and resources to help you navigate financial decisions, like choosing a mortgage or an auto loan, or deciding at what age to claim Social Security retirement benefits.

In observance of our 5th anniversary, here are five ways we’ve made consumers count:

1. Our actions have resulted in $11.7 billion in relief for more than 27 million harmed consumers.

We believe you have the right to be treated fairly in the financial marketplace. We’ve worked to stamp out illegal and predatory practices in the marketplace by supervising financial companies and enforcing consumer protections. Over the past five years, our actions have resulted in billions in relief for millions of consumers harmed by financial companies and individuals that broke the law. We’ve taken legal action against:

- Credit card companies for engaging in unfair, deceptive, and abusive practices related to marketing, billing, and enrollment for credit add-on products and services

- Banks for charging overdraft fees to consumers who had not agreed to overdraft services

- Payday lenders for pressuring borrowers into debt traps

- For-profit colleges for exploiting students and pushing them into unaffordable loans

- Debt collectors for using illegal tactics to intimidate consumers into paying debts they may not owe

- Mortgage companies for wrongly foreclosing on consumers’ homes

2. We’ve handled nearly one million consumer complaints.

You have the right to be heard when you have a problem with a financial product or service. You can submit a complaint to us and we’ll work to make sure you get a response from the company. So far, we’ve handled nearly one million complaints from consumers around the country about problems with their credit cards, bank accounts, credit reports, mortgages, prepaid cards, and more. We also publish complaints to amplify consumers’ voices and improve the consumer financial marketplace.

3. We’ve empowered millions of consumers to “Know Before You Owe.”

When you’re shopping for a mortgage, a student loan, or a credit card, you have the right to clear, reliable information about those products so you can make informed financial decisions. Our “Know Before You Owe” initiative is making information about mortgages, student loans, auto loans, and other financial products and services more understandable to you. Consumers closed on 1.9 million mortgages during the first three months of this year and received our new Loan Estimate and Closing Disclosure forms to help them understand the true cost of borrowing. The financial aid shopping sheet we developed with the Department of Education has been voluntarily adopted by more than 3,400 colleges to help students better understand the type and amount of grants and loans they qualify for. Our newest “Know Before You Owe” tool is a worksheet you can use to compare auto loans before you sign for a loan.

4. We’ve put in place new rules to make the mortgage market safer for you.

We created new “back-to-basics” mortgage rules to address the risky lending and shoddy mortgage servicing that helped cause the financial crisis. Our new rules protect you at every stage of the process—from shopping for a loan, to closing on a mortgage, to paying it back. Our “Know Before You Owe” mortgage disclosure rule gives you clear, easy-to-understand information so you can understand the terms of the deal and comparison shop. Our Ability-to-Repay rule protects you from dangerous lending practices by requiring lenders to verify that you can actually afford to pay back the mortgage they offered you. Our mortgage servicing rules protect you from surprises and runarounds while you are paying back your mortgage, and provide additional protections to help you if you fall behind on your mortgage payment. More than 49 million households have benefited from our mortgage servicing protections.

5. We’re curbing potentially harmful financial practices with new consumer protections nationwide.

You have the right to be protected from harmful financial practices nationwide. We’re working to put in place new consumer protections in several markets, some of them previously unregulated at the federal level. For payday lending, we are seeking comment on a proposed new rule to put an end to payday debt traps that plague a large percentage of the 12 million consumers who take out payday loans each year. This rule would require lenders to assess your ability to repay your debt before they offer you a loan.

Did you know that millions of consumers have entered into contracts for consumer financial products and services that contain an arbitration clause that denies you the right to band together as a group to have a day in court? We’re seeking comment on a proposed rule that would ban companies from using arbitration clauses to block groups of consumers like you from filing lawsuits to pursue justice and relief for wrongdoing.

If you have debt in collection, we’re developing rules to protect you against bad debt collection practices.

If you’re interested in learning more about different aspects of our work, we have factsheets that cover several topics, including an overview of our work by the numbers.

- Explore the work we do to educate, engage, and empower consumers.

- Understand more about how we supervise financial markets and enforce consumer financial law.

- Go in-depth on our work developing consumer protections, how we engage with the consumer financial markets, and understand consumers’ experiences with financial products and services.

We’ll keep working to protect you in the financial marketplace and empowering you to make informed financial decisions. For more information about our work and our tools, visit www.consumerfinance.gov.

Topics

Authors

Kathryn Lee

Find Out More

Apple AirPods are designed to die: Here’s what you should know

A look back at what our unique network accomplished in 2023

Avoiding scams, incorrect medical bills, privacy invasions and more